Your Prince william real estate tax images are ready. Prince william real estate tax are a topic that is being searched for and liked by netizens now. You can Download the Prince william real estate tax files here. Find and Download all free images.

If you’re looking for prince william real estate tax images information linked to the prince william real estate tax keyword, you have come to the right blog. Our website frequently provides you with suggestions for viewing the highest quality video and image content, please kindly search and locate more informative video content and graphics that match your interests.

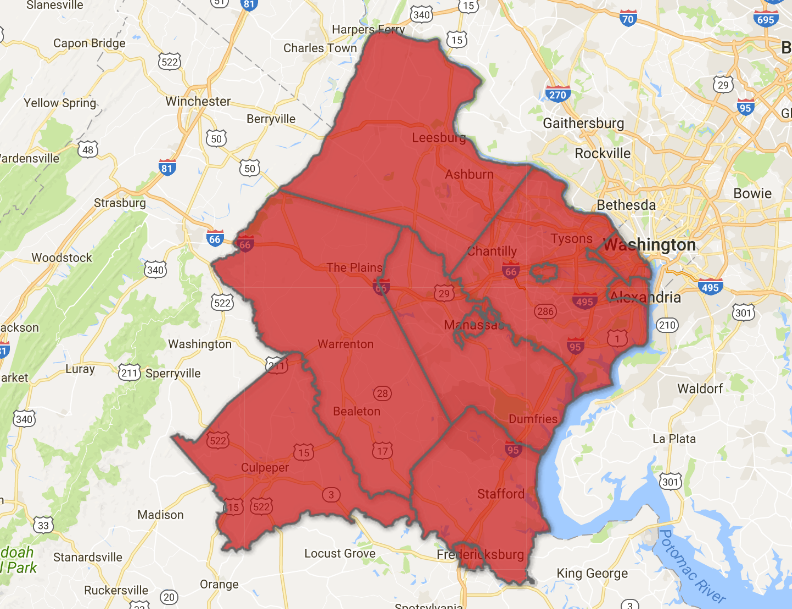

Prince William Real Estate Tax. Commercial Users - Minimum Billing Charge 229 0013487 per kWh not to exceed 10000 per month. Click here to register for an account or here to login if you already have an account. The Board reduced the real estate tax rate from 1125 to 1115 per 100 of assessed value while maintaining a flat fire levy rate of 008 cents per 100 of assessed value. For more information on Prince William County real estate taxes visit Prince William Countys Finance Department or call 703 792-6000.

Extraordinary And Cheeky Prince William Prince Harry Memorialize Grandfather In Separate Statements From forbes.com

Extraordinary And Cheeky Prince William Prince Harry Memorialize Grandfather In Separate Statements From forbes.com

Prince William County Virginia Home. When prompted enter Jurisdiction Code 1036 for Prince William County. Enter the Account Number listed on the billing statement. If you would rather receive this information by email send a request include your. Press 1 for Personal Property Tax. Press 2 to pay Real Estate Tax.

The adopted budget maintains the Boards commitment to its strategic priorities of Quality Education and Workforce Development Wellbeing Safe Secure Community Robust Economy and Mobility including.

Provided by Prince William County Prince William County real estate taxes for the first half of 2020 are due on July 15 2020. For more information on Prince William County real estate taxes visit Prince William Countys Finance Department or call 703 792-6000. The Town of Occoquan real estate tax rate for fiscal year 2020 is 012 per 100 of assessed value. Press 2 for Real Estate Tax. Dial 1-888-2PAY TAX 1-888-272-9829 using a touch tone telephone. As a resident of the Town you are required to pay both Occoquan and Prince William County real estate taxes.

Source: potomaclocal.com

Source: potomaclocal.com

Residential Users - Minimum Billing Charge 140 001509 per kWh not to exceed 300 per month. If you have questions about this site please email the Real Estate Assessments Office. Electricity - Local Consumer Utility Tax. When prompted enter Jurisdiction Code 1036 for Prince William County. Residential Users - Minimum Billing Charge 140 001509 per kWh not to exceed 300 per month.

Source: smartsettlements.com

Source: smartsettlements.com

The Prince William Board of County Supervisors has extended the payment deadline for real estate taxes for the second-half of 2020 by 60 days moving the deadline from Dec. Press 2 for Real Estate Tax. Prince William County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Prince William County Virginia. Please contact us at 703-792-6710 and we will be happy to set this up for you. If you would rather receive this information by email send a request include your.

Source: pwar.com

Source: pwar.com

Dial 1-888-2PAY TAX 1-888-272-9829 using a touch tone telephone. You can pay a bill without logging in using this screen. The Board reduced the real estate tax rate from 1125 to 1115 per 100 of assessed value while maintaining a flat fire levy rate of 008 cents per 100 of assessed value. Please contact us at 703-792-6710 and we will be happy to set this up for you. The average residential real estate tax bill increases 286 264 from the real estate tax and 22 from the fire levy.

Source: forbes.com

Source: forbes.com

The Board reduced the real estate tax rate from 1125 to 1115 per 100 of assessed value while maintaining a flat fire levy rate of 008 cents per 100 of assessed value. The Town of Occoquan real estate tax rate for fiscal year 2020 is 012 per 100 of assessed value. Enter the Account Number listed on the billing statement. For more information on Prince William County real estate taxes visit Prince William Countys Finance Department or call 703 792-6000. This article was written by WTOPs news.

By creating an account you will have access to balance and account information notifications etc. Dial 1-888-2PAY TAX 1-888-272-9829 using a touch tone telephone. For more information on Prince William County real estate taxes visit Prince William Countys Finance Department or call 703 792-6000. The Board reduced the real estate tax rate from 1125 to 1115 per 100 of assessed value while maintaining a flat fire levy rate of 008 cents per 100 of assessed value. All real property in Prince William County except public service properties operating railroads interstate pipelines and public utilities is assessed annually by the Real Estate Assessments Office.

Source: forbes.com

Source: forbes.com

These records can include Prince William County property tax assessments. Dial 1-888-2PAY TAX 1-888-272-9829 using a touch tone telephone. As a resident of the Town you are required to pay both Occoquan and Prince William County real estate taxes. Prince William County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Prince William County Virginia. Commercial Users - Minimum Billing Charge 229 0013487 per kWh not to exceed 10000 per month.

Electricity - Local Consumer Utility Tax. Press 2 to pay Real Estate Tax. Press 1 for Personal Property Tax. There are several convenient ways property owners may make payments. The Town of Occoquan real estate tax rate for fiscal year 2020 is 012 per 100 of assessed value.

Source: forbes.com

Source: forbes.com

You can pay a bill without logging in using this screen. Press 1 for Personal Property Tax. Press 1 to pay Personal Property Tax. When prompted enter Jurisdiction Code 1036 for Prince William County. The Prince William Board of County Supervisors adopted the 135 billion budget for fiscal 2022 which starts July 1 and set tax rates for the new year.

Source: thewealthrecord.com

Source: thewealthrecord.com

The Prince William Board of County Supervisors has extended the payment deadline for real estate taxes for the second-half of 2020 by 60 days moving the deadline from Dec. If you have questions about this site please email the Real Estate Assessments Office. The Town of Occoquan real estate tax rate for fiscal year 2020 is 012 per 100 of assessed value. Please contact us at 703-792-6710 and we will be happy to set this up for you. – Select Tax Type – Business License Business Tangible Property.

Source:

Source:

Press 2 to pay Real Estate Tax. All real property in Prince William County except public service properties operating railroads interstate pipelines and public utilities is assessed annually by the Real Estate Assessments Office. This article was written by WTOPs news. Prince William County Virginia Home. Taxes may be going up in Prince William County after July 1 with a proposed boost in real estate tax bills a new cigarette tax and an increase in the rate on computer equipment a tax mostly paid by data centers.

Source: wtop.com

Source: wtop.com

You can pay a bill without logging in using this screen. Prince William County Virginia Home. The Prince William Board of County Supervisors is poised to reduce the countys real estate property tax rate for the first time since 2016 while increasing the countys data center tax rate and implementing a new cigarette tax to fund the budget for the next fiscal year which begins July 1. If you have questions about this site please email the Real Estate Assessments Office. Click here to register for an account or here to login if you already have an account.

Press 2 to pay Real Estate Tax. Press 1 to pay Personal Property Tax. For more information on Prince William County real estate taxes visit Prince William Countys Finance Department or call 703 792-6000. When prompted enter Jurisdiction Code 1036 for Prince William County. The Prince William Board of County Supervisors has extended the payment deadline for real estate taxes for the second-half of 2020 by 60 days moving the deadline from Dec.

Source: insidenova.com

Source: insidenova.com

Prince William County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Prince William County Virginia. Enter the Account Number listed on the billing statement. The adopted budget maintains the Boards commitment to its strategic priorities of Quality Education and Workforce Development Wellbeing Safe Secure Community Robust Economy and Mobility including. The Prince William Board of County Supervisors adopted the 135 billion budget for fiscal 2022 which starts July 1 and set tax rates for the new year. Electricity - Local Consumer Utility Tax.

Source: insidenova.com

Source: insidenova.com

The Prince William Board of County Supervisors has extended the payment deadline for real estate taxes for the second-half of 2020 by 60 days moving the deadline from Dec. Prince William County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Prince William County Virginia. The Prince William Board of County Supervisors has extended the payment deadline for real estate taxes for the second-half of 2020 by 60 days moving the deadline from Dec. Enter the Account Number listed on the billing statement. A new 4 meals tax is under discussion but would not be considered until next spring.

Source: forbes.com

Source: forbes.com

Residential Users - Minimum Billing Charge 140 001509 per kWh not to exceed 300 per month. Dial 1-888-2PAY TAX 1-888-272-9829. Residential Users - Minimum Billing Charge 140 001509 per kWh not to exceed 300 per month. The Town of Occoquan real estate tax rate for fiscal year 2020 is 012 per 100 of assessed value. As a resident of the Town you are required to pay both Occoquan and Prince William County real estate taxes.

Source: forbes.com

Source: forbes.com

Taxes may be going up in Prince William County after July 1 with a proposed boost in real estate tax bills a new cigarette tax and an increase in the rate on computer equipment a tax mostly paid by data centers. Please contact us at 703-792-6710 and we will be happy to set this up for you. For more information on Prince William County real estate taxes visit Prince William Countys Finance Department or call 703 792-6000. The average residential real estate tax bill increases. Press 2 to pay Real Estate Tax.

Source: insidenova.com

Source: insidenova.com

This article was written by WTOPs news. The Prince William Board of County Supervisors adopted the 135 billion budget for fiscal 2022 which starts July 1 and set tax rates for the new year. Please contact us at 703-792-6710 and we will be happy to set this up for you. Prince William County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Prince William County Virginia. By creating an account you will have access to balance and account information notifications etc.

Source: bizjournals.com

Source: bizjournals.com

Press 2 to pay Real Estate Tax. Provided by Prince William County Prince William County real estate taxes for the first half of 2020 are due on July 15 2020. Enter the Account Number listed on the billing statement. Press 1 to pay Personal Property Tax. For more information on Prince William County real estate taxes visit Prince William Countys Finance Department or call 703 792-6000.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title prince william real estate tax by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.