Your Prince william county real estate tax payments images are ready. Prince william county real estate tax payments are a topic that is being searched for and liked by netizens now. You can Find and Download the Prince william county real estate tax payments files here. Download all royalty-free photos.

If you’re looking for prince william county real estate tax payments images information linked to the prince william county real estate tax payments interest, you have visit the right blog. Our website frequently provides you with hints for seeking the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

Prince William County Real Estate Tax Payments. – Select Tax Type – Business License Business Tangible Property. If you would rather receive this information by email send a request include your name and address. Taxpayer Services will be fully operational for walk-in visitors. However we can assist you in linking your real estate account.

Prince William Supervisors Approve Advertising Tax Rate That Would Hike Bills Wtop From wtop.com

Prince William Supervisors Approve Advertising Tax Rate That Would Hike Bills Wtop From wtop.com

However we can assist you in linking your real estate account. This tax is based on property value and is billed on the first-half and second-half tax bills. ECheck is Prince William Countys automated payment system that allows taxpayers to pay real estate taxes personal property taxes and other taxes over the Internet. Market value is the probable amount that the property would sell for if exposed to the market for a reasonable period with informed buyers and sellers acting without undue pressure. Real Estate Assessments is open to. The total county revenue would have amounted to 13 million under this plan.

These little son of a guns hide in your brush and you just have to push them out.

Press 1 to pay Personal Property Tax. They are maintained by various government offices in Prince William County Virginia State and at the Federal level. Official Test Website of Prince William County Government. This tax is based on property value and is billed on the first-half and second-half tax bills. By mail to PO BOX 1600 Merrifield VA 22116. Prince William County is re-opening county facilities to the public on Wednesday July 1 2020 in accordance with Governor Northams authorization of Phase 3.

Source: realtor.com

Source: realtor.com

Certain types of Tax Records are available to the general public while some Tax. Official website of Prince William County Government. This tax is based on property value and is billed on the first-half and second-half tax bills. You can pay a bill without logging in using this screen. By phone at 1-888-272-9829 jurisdiction code 1036.

The County also levies a supplemental real estate tax. By mail to PO BOX 1600 Merrifield VA 22116. COVID-19 Update June 30 2020. Official Test Website of Prince William County Government. Official website of Prince William County Government.

Enter the Account Number listed on the billing statement. That would amount to a 242 average tax increase for Prince William property owners. Enter your payment card information. Prince William County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Prince William County Virginia. They are a valuable tool for the real estate.

Source: pinterest.com

Source: pinterest.com

Please contact us at 703-792-6710 and we will be happy to set this up for you. You can pay a bill without logging in using this screen. By creating an account you will have access to balance and account information notifications etc. Press 2 for Real Estate Tax. According to a county news release this option saves the time it takes to write and mail a check and the cost of postage.

Source: princewilliamliving.com

Source: princewilliamliving.com

– Select Tax Type – Business License Business Tangible Property. Prince William County real estate taxes for the first half of 2020 are due on July 15 2020. The County also levies a supplemental real estate tax on newly-constructed improvements completed after the beginning of. Press 2 for Real Estate Tax. Taxpayer Services will be fully operational for walk-in visitors.

Source: potomaclocal.com

Source: potomaclocal.com

ECheck is Prince William Countys automated payment system that allows taxpayers to pay real estate taxes personal property taxes and other taxes over the Internet. Houses 2 days ago The real estate tax is paid in two annual installments as shown on the tax calendar. Real Estate Assessments is open to. Press 2 for Real Estate Tax. Press 1 to pay Personal Property Tax.

Source: realtor.com

Source: realtor.com

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Press 2 for Real Estate Tax. These little son of a guns hide in your brush and you just have to push them out. That would amount to a 242 average tax increase for Prince William property owners. Dial 1-888-2PAY TAX 1-888-272-9829 using a touch tone telephone.

Source: insidenova.com

Source: insidenova.com

Follow These Steps to Pay by Telephone. Prince William County Property Records are real estate documents that contain information related to real property in Prince William County Virginia. Press 1 to pay Personal Property Tax. Prince William County re-opened county facilities to the public on Wednesday July 1 2020 in accordance with Governor Northams authorization of Phase 3. COVID-19 Update June 30 2020.

They are maintained by various government offices in Prince William County Virginia State and at the Federal level. Im sort of a softy I couldnt shoot Bambi except with a camera. Included on the real estate tax bills is the special district tax for the gypsy moth abatement program. COVID-19 Update June 30 2020. By creating an account you will have access to balance and account information notifications etc.

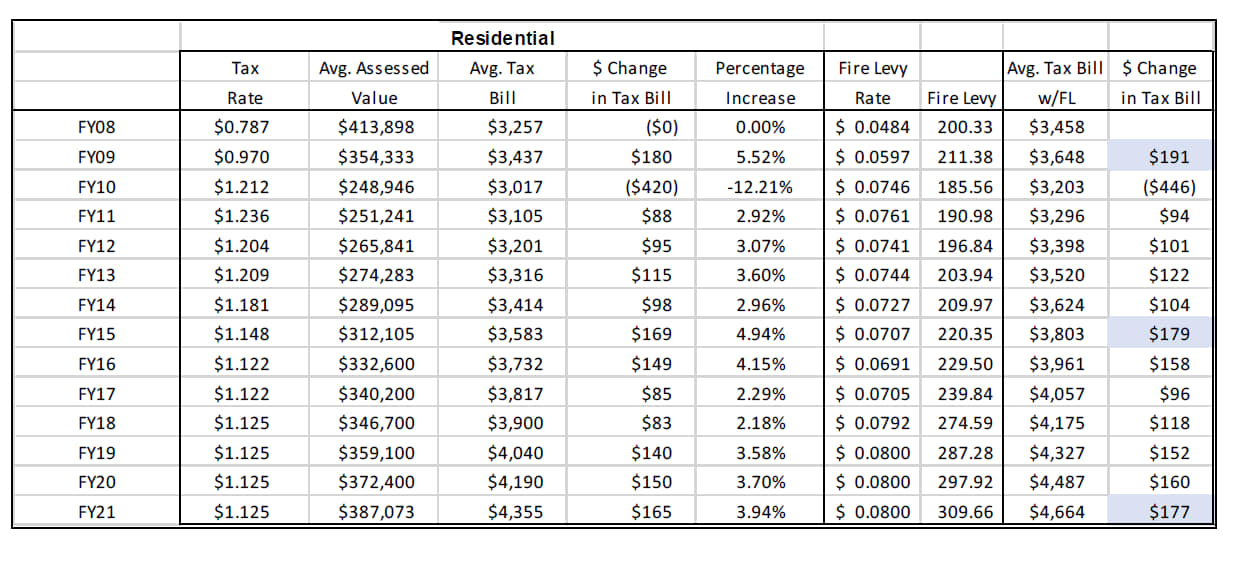

Real Estate Tax - Prince William County Government. Prince William County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Prince William County Virginia. The property tax calculation in Prince William County is generally based on market value. Certain types of Tax Records are available to the general public while some Tax. Thanks to rising real-estate values the flat-tax rate would generate an extra 30 million in general-fund tax revenue for Prince William schools and 22 million more for county services.

Source: smartsettlements.com

Source: smartsettlements.com

Official website of Prince William County Government. There are several convenient ways property owners may make payments. Real Estate Tax - Prince William County Government. By phone at 1-888-272-9829 jurisdiction code 1036. Prince William County re-opened county facilities to the public on Wednesday July 1 2020 in accordance with Governor Northams authorization of Phase 3.

Official website of Prince William County Government. Prince William County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Prince William County Virginia. By phone at 1-888-272-9829 jurisdiction code 1036. The board did not vote on an advertised real-estate tax rate but authorized Martino to advertise his flat-tax rate of 1125 per 100 in assessed value. The system will verbally provide you with a receipt number for you to write down.

Source: bizjournals.com

Source: bizjournals.com

Have pen paper and tax bill ready before calling. Prince William County is re-opening county facilities to the public on Wednesday July 1 2020 in accordance with Governor Northams authorization of Phase 3. According to a county news release this option saves the time it takes to write and mail a check and the cost of postage. Certain types of Tax Records are available to the general public while some Tax. In February the board considered increasing the tax rate to 1145 for every 100 in assessed value.

Source: niche.com

Source: niche.com

Press 2 to pay Real Estate Tax. The property tax calculation in Prince William County is generally based on market value. The County also levies a supplemental real estate tax. If you would rather receive this information by email send a request include your name and address. Im sort of a softy I couldnt shoot Bambi except with a camera.

There are several convenient ways property owners may make payments. However we can assist you in linking your real estate account. By mail to PO BOX 1600 Merrifield VA 22116. The County also levies a supplemental real estate tax. That would amount to a 242 average tax increase for Prince William property owners.

Enter the Account Number listed on the billing statement. The real estate tax is paid in two annual installments as shown on the tax calendar. By mail to PO BOX 1600 Merrifield VA 22116. Real Estate Tax - Prince William County Government. Real Estate Assessments is open to.

They are maintained by various government offices in Prince William County Virginia State and at the Federal level. By creating an account you will have access to balance and account information notifications etc. These little son of a guns hide in your brush and you just have to push them out. According to a county news release this option saves the time it takes to write and mail a check and the cost of postage. Houses 2 days ago The real estate tax is paid in two annual installments as shown on the tax calendar.

Source: wtop.com

Source: wtop.com

Real Estate Tax - Prince William County Government. Taxpayer Services will be fully operational for walk-in visitors. By creating an account you will have access to balance and account information notifications etc. ECheck is Prince William Countys automated payment system that allows taxpayers to pay real estate taxes personal property taxes and other taxes over the Internet. Official Test Website of Prince William County Government.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title prince william county real estate tax payments by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.