Your Peoria county real estate taxes images are available. Peoria county real estate taxes are a topic that is being searched for and liked by netizens today. You can Find and Download the Peoria county real estate taxes files here. Find and Download all free photos.

If you’re searching for peoria county real estate taxes images information linked to the peoria county real estate taxes topic, you have pay a visit to the ideal blog. Our website always gives you hints for seeking the maximum quality video and picture content, please kindly surf and find more enlightening video articles and graphics that match your interests.

Peoria County Real Estate Taxes. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. Peoria County Real Estate Taxes to Be Mailed by May 1. Peoria County officials will be asked Thursday evening to break up the amount due for residents first installment of real estate taxes into two payments to help those struggling with their. This information is sent to the County Treasurer whose office prepares and mails each tax bill.

1420 E Beach St Peoria Il 61615 Zillow From zillow.com

1420 E Beach St Peoria Il 61615 Zillow From zillow.com

At the sale tax buyers will bid on the percentage of penalty that will be charged to the taxpayer. Annually the Peoria County Treasurer holds a tax sale of all the current delinquent real estate taxes. Visit the Peoria County property tax page. Once the amounts of the levies for each of the taxing bodies have been set the County Clerk tax staff calculates and applies extends the tax rate for each taxing district which is applied to each property. Any No HOA Fee 50month100month200month300. Please make check payable to Peoria County.

Real Estate Tax Prepayment Program.

Peoria County officials will be asked Thursday evening to break up the amount due for residents first installment of real estate taxes into two payments to help those struggling with their. Please make check payable to Peoria County Collector and mail payment to. The acceptance period is from Tuesday December 1 through Thursday December 31 2020. Visit the Peoria County property tax page. Annually the Peoria County Treasurer holds a tax sale of all the current delinquent real estate taxes. Yearly median tax in Peoria County The median property tax in Peoria County Illinois is 2385 per year for a home worth the median value of 119000.

Source: zillow.com

Source: zillow.com

Peoria County Real Estate Taxes to Be Mailed by May 1. Peoria County officials will be asked Thursday evening to break up the amount due for residents first installment of real estate taxes into two payments to help those struggling with their. Peoria County Property Tax Information. Peoria County Treasurer 324 Main Street Room G-15 Peoria IL 61602 Phone. There are no unsold taxes available after the tax sale.

Source: realtor.com

Source: realtor.com

Real Estate Tax Prepayment Program. Once the amounts of the levies for each of the taxing bodies have been set the County Clerk tax staff calculates and applies extends the tax rate for each taxing district which is applied to each property. The median property tax also known as real estate tax in Peoria County is 238500 per year based on a median home value of 11900000 and a median effective property tax rate of 200 of property value. Peoria County Real Estate Taxes to Be Mailed by May 1. First Installment Due June 8 Peoria County Treasurer Nicole Bjerke announced approximately 82500 tax bills will be mailed to Peoria County residents by May 1 2021.

Source: realtor.com

Source: realtor.com

Peoria County Property Tax Information. Visit the Peoria County property tax page. Peoria County officials will be asked Thursday evening to break up the amount due for residents first installment of real estate taxes into two payments to help those struggling with their. Peoria County Property Tax Information. The median property tax also known as real estate tax in Peoria County is 238500 per year based on a median home value of 11900000 and a median effective property tax rate of 200 of property value.

Source: zillow.com

Source: zillow.com

The median property tax also known as real estate tax in Peoria County is 238500 per year based on a median home value of 11900000 and a median effective property tax rate of 200 of property value. Peoria County collects on average 2 of a propertys assessed fair market value as property tax. Peoria County Property Tax Information. Peoria County Clerk Rachael Parker 324 Main Street Room 101 Peoria IL 61602 Phone. Peoria County officials will be asked Thursday evening to break up the amount due for residents first installment of real estate taxes into two payments to help those struggling with their.

Source:

Source:

Annually the Peoria County Treasurer holds a tax sale of all the current delinquent real estate taxes. Visit the Peoria County property tax page. Peoria County Treasurer 324 Main Street Room G-15 Peoria IL 61602 Phone. Free Peoria County Property Records Search. There are no unsold taxes available after the tax sale.

Source: zillow.com

Source: zillow.com

Please make check payable to Peoria County. Free Peoria County Property Records Search. The Peoria County Treasurer is pleased to announce the continuation of the real estate prepayment program for the 2020 taxes payable in 2021. Peoria County Real Estate Taxes to Be Mailed by May 1. Over 325 million was collected and distributed to over 140 taxing districts within Peoria County every 4 weeks during tax collection time.

Source: realtor.com

Source: realtor.com

Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. Over 325 million was collected and distributed to over 140 taxing districts within Peoria County every 4 weeks during tax collection time. Real Estate Tax Prepayment Program. Peoria County Clerk Rachael Parker 324 Main Street Room 101 Peoria IL 61602 Phone. Please make check payable to Peoria County.

Source: realtor.com

Source: realtor.com

Visit the Peoria County property tax page. At the sale tax buyers will bid on the percentage of penalty that will be charged to the taxpayer. Peoria County officials will be asked Thursday evening to break up the amount due for residents first installment of real estate taxes into two payments to help those struggling with their. Peoria County Real Estate Records. All Tax Buyers must be present to bid.

Source: realtor.com

Source: realtor.com

The Peoria County Treasurer is pleased to announce the continuation of the real estate prepayment program for the 2020 taxes payable in 2021. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. At the sale tax buyers will bid on the percentage of penalty that will be charged to the taxpayer. Peoria County Clerk Rachael Parker 324 Main Street Room 101 Peoria IL 61602 Phone. Please make check payable to Peoria County Collector and mail payment to.

Source: growpeoria.com

Source: growpeoria.com

Free Peoria County Property Records Search. Peoria County Collector PO Box 1925 Peoria httpsreal-estate-usinfopeoria-county-real-estate-records. Real Estate Tax Prepayment Program. The Peoria County Treasurer is pleased to announce the continuation of the real estate prepayment program for the 2020 taxes payable in 2021. All Time 40 New Post Past 24 Hours Past Week Past month Peoria County Property Tax Information Peoria County Property Tax Information.

Source: realtor.com

Source: realtor.com

All Time 40 New Post Past 24 Hours Past Week Past month Peoria County Property Tax Information Peoria County Property Tax Information. For the tax year 2018 payable 2019 the Peoria County Treasurer mailed out approximately 83500 real estate tax bills. Peoria County Collector PO Box 1925 Peoria httpsreal-estate-usinfopeoria-county-real-estate-records. Over 325 million was collected and distributed to over 140 taxing districts within Peoria County every 4 weeks during tax collection time. Annually the Peoria County Treasurer holds a tax sale of all the current delinquent real estate taxes.

Source: realtor.com

Source: realtor.com

All Tax Buyers must be present to bid. Peoria County officials will be asked Thursday evening to break up the amount due for residents first installment of real estate taxes into two payments to help those struggling with their. The median property tax also known as real estate tax in Peoria County is 238500 per year based on a median home value of 11900000 and a median effective property tax rate of 200 of property value. All Tax Buyers must be present to bid. Peoria County Clerk Rachael Parker 324 Main Street Room 101 Peoria IL 61602 Phone.

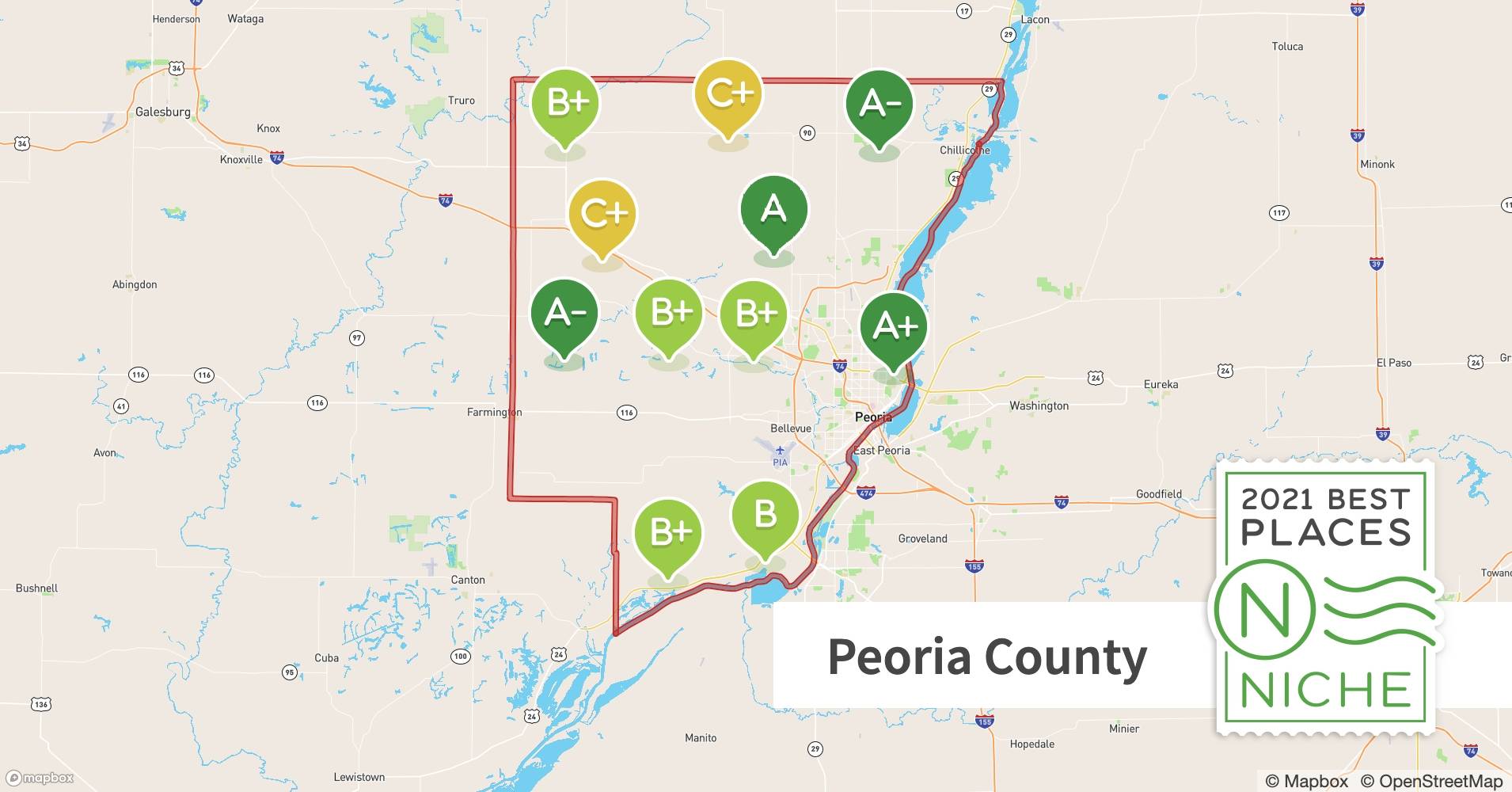

Source: niche.com

Source: niche.com

Annually the Peoria County Treasurer holds a tax sale of all the current delinquent real estate taxes. Peoria County Treasurer 324 Main Street Room G-15 Peoria IL 61602 Phone. The median property tax also known as real estate tax in Peoria County is 238500 per year based on a median home value of 11900000 and a median effective property tax rate of 200 of property value. Peoria County Collector PO Box 1925 Peoria httpsreal-estate-usinfopeoria-county-real-estate-records. All Time 40 New Post Past 24 Hours Past Week Past month Peoria County Property Tax Information Peoria County Property Tax Information.

Source: zillow.com

Source: zillow.com

Yearly median tax in Peoria County The median property tax in Peoria County Illinois is 2385 per year for a home worth the median value of 119000. This information is sent to the County Treasurer whose office prepares and mails each tax bill. The Peoria County Treasurer is pleased to announce the continuation of the real estate prepayment program for the 2020 taxes payable in 2021. All Tax Buyers must be present to bid. Annually the Peoria County Treasurer holds a tax sale of all the current delinquent real estate taxes.

Source: realtor.com

Source: realtor.com

Property Taxes After the Tax Assessor sets the value of properties and before the County Treasurer mails the tax bills and collects the taxes the County Clerks office performs a series. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. Peoria County collects on average 2 of a propertys assessed fair market value as property tax. All Tax Buyers must be present to bid. Peoria County Real Estate Records.

Source:

Source:

Peoria County Real Estate Records. This information is sent to the County Treasurer whose office prepares and mails each tax bill. Peoria County Collector PO Box 1925 Peoria httpsreal-estate-usinfopeoria-county-real-estate-records. The acceptance period is from Tuesday December 1 through Thursday December 31 2020. The Peoria County Treasurer is pleased to announce the continuation of the real estate prepayment program for the 2020 taxes payable in 2021.

Source: zillow.com

Source: zillow.com

Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. Any No HOA Fee 50month100month200month300. Peoria County Collector PO Box 1925 Peoria httpsreal-estate-usinfopeoria-county-real-estate-records. Find Peoria County residential property records including property owners sales transfer history deeds titles property taxes valuations land zoning records. Once the amounts of the levies for each of the taxing bodies have been set the County Clerk tax staff calculates and applies extends the tax rate for each taxing district which is applied to each property.

This information is sent to the County Treasurer whose office prepares and mails each tax bill. Real Estate Tax Prepayment Program. Over 325 million was collected and distributed to over 140 taxing districts within Peoria County every 4 weeks during tax collection time. This information is sent to the County Treasurer whose office prepares and mails each tax bill. All prior years taxes must be current to participate in this program.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title peoria county real estate taxes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.